IndianOil HDFC Bank Credit Card, Rewards and Benefits, Joining Fees & Charges, Apply Online

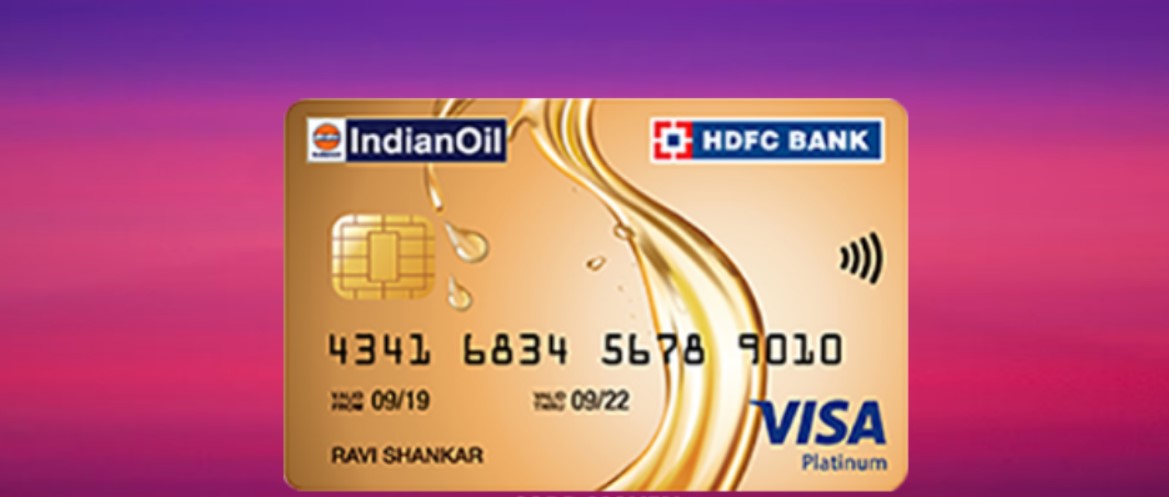

The IndianOil HDFC credit card stands as a powerful collaboration between HDFC Bank and IndianOil, offering unique benefits tailored for fuel enthusiasts. With a focus on rewarding fuel purchases, this co-branded credit card presents an enticing proposition for those seeking savings on their fuel expenses.

Comparable to its counterpart, the IndianOil Axis Bank Credit Card, issued in partnership with the Indian Oil Corporation Limited, this card presents a formidable competitor in the market. Both cards vie for the attention of consumers seeking optimal fuel rewards and benefits.

Earning and Redeeming Fuel Points:

Earn fuel points with every transaction, allowing you to accumulate rewards for future fuel purchases at Indian Oil Petrol pumps. You can redeem these points for up to 50 liters of free fuel annually, providing significant savings on your fuel expenses.

Membership to IndianOil XTRAREWARDS Program (IXRP):

Enjoy complimentary membership to the IndianOil XTRAREWARDS Program (IXRP), enhancing your redemption options. With a favorable redemption rate of 1 FP = Re. 0.96, you can leverage your fuel points not only for fuel purchases but also for a variety of products, vouchers, and other categories, maximizing the value of your rewards.

Convenience and Affordability:

Link your credit card to UPI, leveraging the RuPay network for seamless transactions and enhanced convenience. Additionally, benefit from a nominal joining fee of Rs 500, which can be waived by meeting a spending threshold of Rs 20,000 within the first 90 days of card issuance.

| Fees | Joining Fee- Rs. 500+ GST Renewal Fee- Rs. 500+ GST |

| Best Suited For |

Travel |

| Reward Type | Reward Points |

| Welcome Benefits | 1 complimentary 6E Prime add-on with priority check-in, complimentary meal, quicker baggage, choice of seat, etc. |

Rewards and Benefits

Experience unparalleled rewards and protection with the IndianOil HDFC credit card, a dynamic collaboration between HDFC Bank and IndianOil, designed to elevate your fuel purchasing experience.

Rewards Structure:

Earn 5% of your spends as Fuel Points at IndianOil outlets, groceries, and bill payments, ensuring substantial savings on essential expenses. Additionally, earn 1 Fuel Point for every Rs. 150 spent on all other purchases, offering a rewarding rate of up to 4.8%.

Redeeming Rewards:

Fuel Points earned can be redeemed for Free Fuel through the complimentary IndianOil XTRAREWARDS Program (IXRP) membership at IndianOil outlets, with an attractive redemption rate of 1 FP = 96 Paise. Alternatively, leverage net-banking to redeem points towards catalog products (1 FP = 20 Paise) or opt for cashback on the credit card (1 FP = 20 Paise), providing flexibility in how you utilize your rewards.

Protection and Security:

Benefit from Zero Liability Protection, offering peace of mind against unauthorized transactions. In the event of loss or theft, report it to the bank within 24 hours to avail of zero liability, ensuring your financial security at all times.

Discover the Value:

While the card may not offer specific benefits such as movie and dining perks, its focus on fuel rewards and robust protection makes it a compelling choice for those prioritizing savings and security. Elevate your fuel purchasing experience and enjoy peace of mind with the IndianOil HDFC credit card.

In summary, unlock the power of rewards and protection with the IndianOil HDFC credit card, where every transaction fuels your savings and every swipe enhances your security. Embrace a new standard of convenience and confidence in your financial transactions with this dynamic credit card offering.

Fees & Charges

Unlock exclusive benefits and savings with the IndianOil HDFC credit card, offering a range of perks tailored to your lifestyle.

Spend-Based Waiver:

Enjoy the convenience of having your renewal fee waived upon spending Rs. 50,000, ensuring that your loyalty is rewarded with continued benefits.

Rewards Redemption Fee:

Redeem your rewards seamlessly with a nominal fee of Rs. 99 per redemption request, allowing you to access your earned benefits with ease.

Foreign Currency Markup:

Transact globally with confidence, knowing that your foreign currency transactions incur only a minimal markup of 3.5%, making international spending more affordable and convenient.

Interest Rates:

Benefit from competitive interest rates of 3.6% per month (or 43.2% per annum), ensuring that your financial transactions remain manageable and cost-effective.

Fuel Surcharge:

Receive a fuel surcharge waiver of 1% on minimum fuel transactions of Rs. 400, adding value to your fuel purchases and helping you save on essential expenses.

Cash Advance Charges:

Access cash when you need it with cash advance charges of 2.5% of the amount withdrawn, subject to a minimum charge of Rs. 500, providing flexibility and convenience in managing your finances.

Add-on Card Fee:

Enhance your card benefits with add-on cards at no additional fee, allowing you to share the perks with your loved ones seamlessly.

Experience the convenience, savings, and flexibility offered by the IndianOil HDFC credit card, tailored to meet your diverse financial needs and aspirations. Embrace a world of rewards and benefits, making every transaction more rewarding and enjoyable.

Product Details

Unlock exclusive benefits with the IndianOil XTRAREWARDS Program membership, completely complimentary. Enjoy a renewal fee waiver when your annual spends exceed Rs 50,000 in the previous year. Earn 5% of your spends back as Fuel Points when you shop at IndianOil outlets, grocery stores, and make bill payments. Plus, get 1 Fuel Point for every Rs 150 spent on all other purchases.

As a bonus, IndianOil HDFC Bank credit cardholders can receive up to 50 liters of free fuel annually. What’s more, enjoy the convenience of a waived fuel surcharge of 1% on all fuel transactions at any fuel station across India.

Experience the ease and rewards of fueling up with IndianOil, and let your spending work for you.

Introducing the IndianOil HDFC Bank Credit Card, a powerful fuel credit card collaboration between HDFC Bank and Indian Oil Corporation Limited. Beyond its fuel benefits, this card boasts a plethora of additional features and perks, outlined below:

Seamless UPI Integration:

Connect your HDFC IndianOil Credit Card effortlessly to your preferred UPI application, enabling convenient payments directly from your mobile device.

Spend-Based Fee Waiver:

Enjoy a renewal fee waiver if your annual spends exceed Rs. 50,000 in the preceding year.

Fuel Surcharge Relief:

Say goodbye to the 1% fuel surcharge on fuel transactions exceeding Rs. 400 at any fuel station nationwide. Earn up to Rs. 250 cashback per statement cycle.

Rewarding Fuel Points:

Earn Reward Points in the form of Fuel Points with every transaction:

– Gain up to 5% of your expenditure as Fuel Points at IndianOil outlets, grocery stores, and bill payments. (For the first 6 months, earn a maximum of 250 Fuel Points per month, and post 6 months, up to 150 Fuel Points.)

– Avail of 5% Fuel Points on grocery and utility bill payments, capped at 100 Fuel Points in each category.

– Receive 1 Fuel Point for every Rs. 150 spent on all other purchases.

– Fuel Points remain valid for 2 years before expiration.

– Exceptions include no Fuel Points earned for wallet reloads, government transactions, EMI payments, rent, or gold purchases.

Application Process:

Apply offline by visiting the nearest bank branch, completing the application form, and attaching the necessary documents. Alternatively, apply online by following these steps:

1. Click on “Apply Now.”

2. Fill out the required details such as name and PAN card.

3. Submit your application and await approval.

IndianOil HDFC Bank RuPay Credit Card:

Tailored for individuals with significant fuel expenditures, this card offers:

– Accelerated 5% Fuel Points on IndianOil outlet spends, utility bill payments, and grocery shopping.

– Diverse redemption options including fuel purchases and shopping.

– Through the XTRAREWARDS Program (IXRP), enjoy a rewarding Rs. 0.96 reward rate on fuel spending.

– Obtain fee waivers by spending Rs. 50,000 in a card anniversary year, making it a truly cost-effective choice.