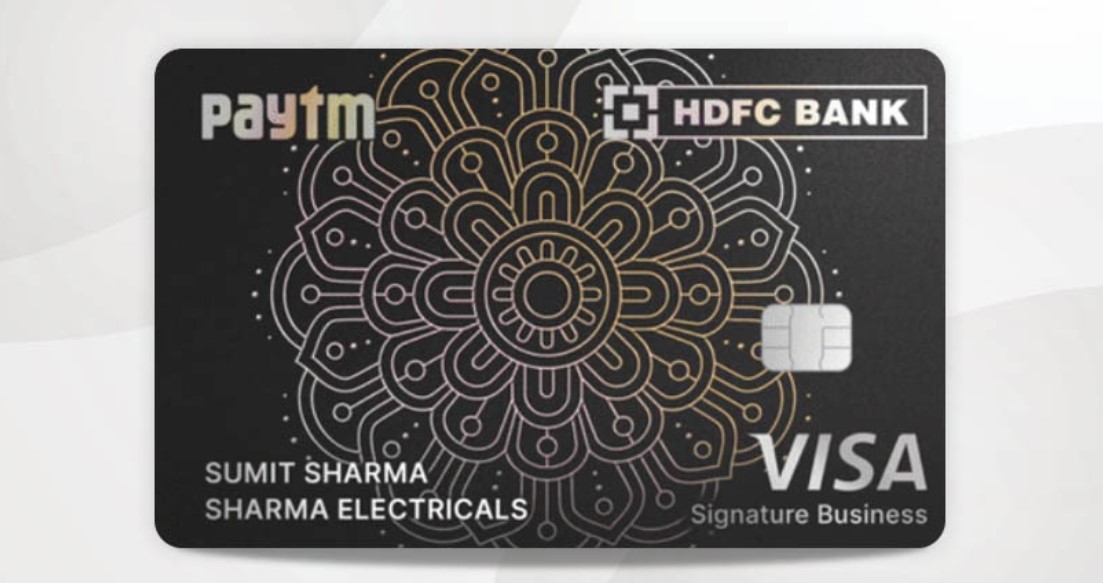

Paytm HDFC Bank Select Credit Card, Rewards and Benefits, Joining Fees & Charges, Apply Online

HDFC Bank and Paytm have joined forces to introduce three personal credit cards, namely the Paytm HDFC Select Credit Card, Paytm HDFC Bank Credit Card, and Paytm HDFC Bank Mobile Credit Card, along with two business credit cards. Among these, the Paytm HDFC Select Credit Card stands out as the most premium option offered by the bank in partnership with Paytm.

The Paytm HDFC Select Credit Card carries an annual fee of Rs. 1,000 and boasts a maximum reward rate of 5% on spends made on Paytm Mall, movies, and Mini apps. Cardholders also enjoy a complimentary Paytm First membership and eight complimentary lounge accesses at domestic airports nationwide. This co-branded offering by HDFC and Paytm aims to enhance the benefits and convenience for customers.

| Fees | Joining Fee- Rs. 1000 + GST Renewal Fee- Rs. 1000 + GST |

| Best Suited For |

Shopping |

| Reward Type | Reward Points |

| Welcome Benefits | Complimentary Paytm First membership |

Rewards and Benefits

It seems you’re describing a co-branded credit card offered by HDFC and Paytm. Here’s a summary of its key features:

- Rewards Rate: Offers 5% cashback on Paytm Mall/Movies/Mini app, 3% accelerated cashback on select brands like Ajio, BigBasket, Swiggy & Uber, and 1% cashback on all other eligible retail spends.

- Reward Redemption: Cashpoints can be redeemed as cashback against the statement balance or against travel benefits like flight & hotel bookings and rewards catalogue at the SmartBuy Rewards Portal.

- Travel Benefits: Includes complimentary domestic airport lounge access.

- Domestic Lounge Access: Provides 8 complimentary domestic airport lounge access every year (max 2 per quarter).

- Insurance Benefits: Not specified.

- Zero Liability Protection: The cardholder is not liable for any fraudulent transactions made with the card after reporting the loss of the card to the bank.

Please note that these benefits may vary, so it’s advisable to check the specific terms and conditions of the card before applying.

Fees & Charges

- Spend-Based Waiver: The joining fee is waived if you spend a minimum of Rs. 50,000 within the first 90 days of card issuance. The annual fee for subsequent years is waived off on spending a minimum of Rs. 1.5 lakh in the preceding 12 months.

- Rewards Redemption Fee: There is no fee for redeeming rewards.

- Foreign Currency Markup: A 3.5% markup is applied on transactions made in foreign currency.

- Interest Rates: The interest rate is 3.6% per month or 43.2% annually.

- Fuel Surcharge: A 1% fuel surcharge is waived off on fuel purchases of at least Rs. 400, with a maximum waiver of Rs. 500 per month.

- Cash Advance Charges: Cash advance charges are 2.5% of the transaction amount, with a minimum charge of Rs. 500.

- Add-on Card Fee: There is no fee for an add-on card.

Product Details

- As a new member of the Paytm First loyalty program, you’ll enjoy a range of exclusive benefits. Receive a warm welcome with a complimentary membership, and earn rewards on your purchases. Get 5% cashback on all purchases at Paytm Mall, Movies, and Mini app, along with 2% cashback on all other spends on Paytm, and 1% cashback on all other retail spends with the card.

- Experience luxury and convenience with 8 complimentary domestic airport lounge access across the country, with a maximum of 2 per quarter. Additionally, get gift vouchers worth Rs. 500 on quarterly expenditure of a minimum of Rs. 50,000.

- Joining fee is waived off on spending a minimum of Rs. 50,000 within 90 days of card issuance. For the subsequent years, enjoy a waiver on the annual membership fee of the card on a minimum expenditure of Rs. 1.5 lakhs in the preceding year. Enjoy the perks of the Paytm First credit card and make your shopping and travel experiences even more rewarding.

Paytm HDFC Bank Select Credit Card Features and Benefits

The Paytm HDFC Bank Select Credit Card stands out as a premium offering among the trio of Paytm co-branded credit cards by HDFC. Alongside cashback rewards, it presents a range of exclusive benefits such as complimentary Paytm First membership, gift vouchers, and travel perks.

Welcome Benefit: New cardholders receive a complimentary membership of the Paytm First program with the Paytm HDFC Select Credit Card.

Milestone Benefit: Earn gift vouchers worth Rs. 500 by spending a minimum of Rs. 50,000 (excluding EMI transactions) in a calendar quarter. Choose from categories like Health & Wellness, Shopping, Entertainment, and Food delivery.

Joining Fee Waiver: The joining fee (first year’s membership fee) of the card is waived off on a minimum expenditure of Rs. 50,000 in the first 90 days of card issuance.

Annual Renewal Fee Waiver: Enjoy a waiver on the annual renewal fee (second year onwards) of the card on an expenditure of a minimum of Rs. 1.5 lakhs in the preceding year.

Travel Benefits: Cardholders are entitled to 8 complimentary lounge accesses every year (maximum 2 per quarter) at domestic airports across India.

Fuel Surcharge Waiver: Get a 1% waiver on the surcharge applicable on fuel purchases made with the HDFC Paytm Select Credit Card. The waiver is applicable only on fuel transactions greater than Rs. 400, with a maximum waived amount capped at Rs. 500 per statement cycle.

Rewards: This cashback-based credit card offers rewards in the form of Paytm Gift Vouchers:

- 5% cashback on all spends with the Paytm app (Recharge, Utility, Travel, Movies & Mini App), with a maximum cap of Rs. 1500 per month.

- 3% cashback on select brands like Ajio, Swiggy, Uber, and BigBasket, with a maximum cap of Rs. 500 per month.

- 1% cashback on all other retail spends with the card, with a maximum cap of Rs. 2,000 per month.

- No cashback is earned on fuel, rental payments, and government spends.

Reward Redemption: Cashback earned on the Paytm HDFC Bank Select Credit Card is given as Cashpoints, which can be redeemed against an outstanding balance as cashback or for other categories such as Smartbuy (Flights/Hotels) and Airmiles & Product Catalogue.

Fees & Charges: HDFC Bank charges an annual fee of Rs. 1,000 (plus applicable taxes) for the Paytm HDFC Bank Credit Card. Cash advance fee is 2.5% of the withdrawn amount (minimum fee of Rs. 500) on cash withdrawals from ATMs.

Add-on Cards: Cardholders can get up to 4 add-on credit cards with their Paytm HDFC Bank Credit Card at no extra fee.

Advantages:

- Paytm First Membership: Enjoy a complimentary annual membership of the Paytm First loyalty program with exclusive discounts and deals on Paytm and partner brands.

- Gift Voucher: Receive a complimentary gift voucher worth Rs. 500 on spending a minimum of Rs. 50,000 with the card in a given quarter (up to Rs. 200 in a year).

- Domestic Airport Lounge Access: Access complimentary domestic airport lounges across the country.

Drawbacks:

- Not ideal for those who don’t frequently spend on Paytm/Paytm Mall, as the reward rate for other merchants is just 1%.

- The membership fee of Rs. 1,000/annum is higher compared to competitors like Amazon Pay ICICI Bank Credit Card (lifetime free) and Flipkart Axis Bank Credit Card (Rs. 500/annum), although the latter doesn’t offer any complimentary airport lounge access.

Customer Care: HDFC Bank provides 24×7 customer care support to its credit card customers. Cardholders can dial the bank’s helpline numbers 1860 267 6161 or 61606161 (prefix STD code) to report a lost card or for assistance. When abroad, cardholders can dial 022 61606160 to reach HDFC’s overseas customer care desk.

Paytm HDFC Bank Select Credit Card Review

The Paytm HDFC Bank Select Credit Card is a co-branded offering ideal for frequent Paytm users. It stands out as the most premium variant among the co-branded cards issued by Paytm and HDFC Bank, available with a Rs. 1000 joining fee. With a complimentary Paytm First membership, this card offers 5% cashback on Paytm purchases and 3% cashback on popular brands like Ajio, Swiggy, BigBasket, and Uber.

In addition, cardholders receive 1% cashback on spends elsewhere and up to 8 complimentary domestic lounge access, max twice per quarter. The joining fee can be waived on spending Rs. 50,000 within 90 days, and there’s a renewal fee waiver on spending Rs. 1.5 Lakhs in the anniversary year. If you regularly use Paytm for your daily transactions, this credit card is a perfect choice for you.

I have recommended your blog to all of my friends and family Your words have the power to change lives and I want others to experience that as well