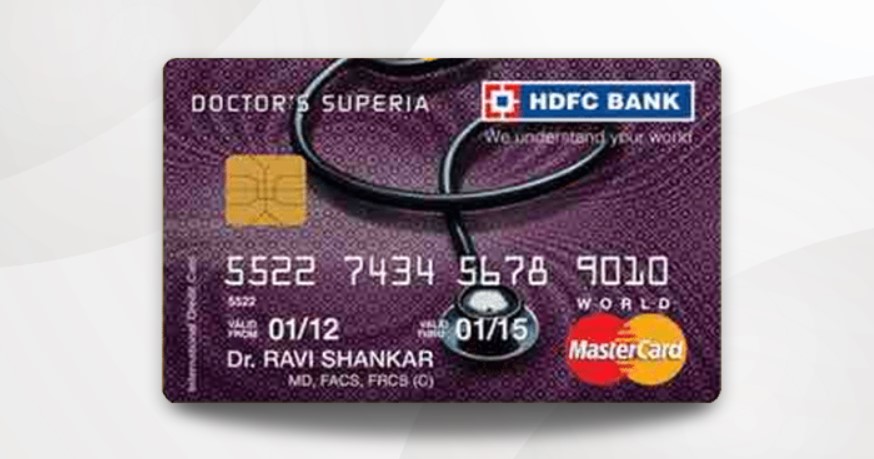

HDFC Bank Doctor’s Superia Credit Card

The HDFC Bank Doctor’s Superia Credit Card is a reward-based card that is exclusively designed to complement the hectic life of doctors. You can earn accelerated reward points with this card. Cardholders who travel often can benefit immensely from this credit card as the reward points can be converted into AirMiles and can be further redeemed to book flight tickets from over 20 international airlines or any major domestic airline. An eligible applicant can own this card after submitting a joining fee of Rs. 1,000 and the card is renewable at a fee of Rs. 1,000 per annum which can be waived off on the basis of your spendings.

This card also offers special dining benefits so that doctors can enjoy extra reward points while dining out and paying through this card. HDFC Bank Doctor’s Superia Credit Card also provides you insurance cover worth up to Rs. 20 Lakhs which secures them in cases of unfortunate events. Apart from these benefits, there are further fees and rewards associated with this card which you can learn more about below :

- Joining Fee- Rs. 1,000

- Renewal Fee- Rs. 1,000

- Best Suited For- Dining | Shopping

- Reward Type- Reward Points

- Welcome Benefits- Enjoy 1,000 reward points as a welcome benefit on payment of the joining fee.

Rewards and Benefits

- Movie & Dining- Enjoy 50% more reward points every time you dine out at a restaurant.

- Rewards Rate- Earn 3 reward points on spend of every Rs.150

- Reward Redemption- The earned points can be redeemed to get AirMiles where 667 Reward Points = 100 AirMiles. The reward points can also be redeemed for exclusive gifts listed in the reward catalog.

- Travel- NA

- Golf- NA

- Domestic Lounge Access- NA

- International Lounge Access- NA

- Insurance Benefits- N/A

- Zero Liability Protection- The cardholder shall not be liable for any fraudulent transaction made with the card post reporting the loss of card to the bank.

Fees & Charges

- Spend based Waiver- Spend Rs. 1 Lakh in a year and get waiver of next year’s annual membership fee

- Rewards Redemption Fee- NA

- Foreign Currency Markup- 3.5% on all international transactions

- Interest Rates- 3.6% per month (43.2% per annum)

- Fuel Surcharge- Get 1% fuel surcharge on transactions between Rs. 400 and Rs. 5000 (max waiver capped at Rs. 250 per statement cycle)

- Cash Advance Charge- 2.5% of the amount withdrawn (subject to a minimum of Rs. 500)

- Add-on Card Fee- Nil

Product Details

- Welcome benefit of 1,000 Reward points

- Renewal benefit of 1,000 Reward points

- Reward Points are redeemable against Airmiles for several Airlines

- 50% more reward points are credited to your account on dining spends.

- Professional Indemnity Insurance coverage up to Rs. 20 Lakhs

- Up to 50 interest free days from the date of purchase.

HDFC Bank Doctor’s Superia Credit Card Features and Benefits

HDFC Bank Doctor’s Superia Credit Card is specially designed for the doctors and comes with an array of features that are curated to benefit them. This card comes with amazing offers related to reward points, dining, travel, and insurance. Read more about these features and benefits below :

Welcome Benefits

- You entitled to get 1000 reward points as a welcome benefit.

- The welcome benefit is subject to the payment of the joining fee.

Reward Benefits

- You earn 3 Reward Points on every spend of Rs. 150.

- You can earn 50% more Reward Points on spends made on dining through this card.

Reward Redemption

- Redeem your reward points to get free Airmiles where 667 Reward Points = 100 AirMiles

- Reward Points can also be redeemed by choosing your own reward from the exclusive HDFC Bank Reward Catalog. They can be redeemed by logging in to your internet banking account via HDFC Bank’s official website.

Dining Benefits

This card gives you 50% more reward points when you dine in restaurants so that you find tons of reasons to enjoy your meal and dine out.

Insurance Benefits

- Get insurance coverage worth upto Rs. 20 Lakhs against costs arising due to professional negligence under Professional Indemnity Insurance (Up to Rs.4 Lakh per accident).

- The policy covers the injury or death of any patient caused by error or negligence in the professional service provided.

- It also covers defence expenses and legal costs so that your profession is safeguarded and you get to defend your case if the need arises without worrying about the fees associated.

Fuel Surcharge Waiver

You get 1% of fuel surcharge waived at all petrol stations in India. The transaction amount should be between Rs. 400 and Rs. 5000 (waiver capped at Rs. 250 per statement cycle)

Renewal Benefit

You are entitled to 1000 Reward Points every time you get your HDFC Bank Doctor’s Superia Credit Card renewed

Spend Based Waiver

Annual membership fee of Rs. 1000 can be waived if you spend Rs. 1 Lakh or more in the previous year

HDFC Bank Doctor’s Superia Credit Card : Fees and Charges

- You have to pay an annual fee of Rs 1,000 for the HDFC Bank Doctor’s Superia Credit Card.

- The renewal charges of this card are Rs. 1000

- An interest rate of 3.6% per month (or 42.3% annually) is levied on this card.

- Foreign Currency mark-up fee of 3.5% of the transaction amount is applicable on all foreign currency transactions made with HDFC Bank Doctor’s Superia Credit Card.

- A cash withdrawal fee of 2.5% of the withdrawn amount is applicable on all cash withdrawals made with the card at ATMs (subject to a minimum of Rs. 500)

Eligibility Criteria for HDFC Bank Doctor’s Superia Credit Card

- The applicant must be an Indian Doctor

- If the applicant is a salaried doctor then he must be between 21 to 60 years of age

- If the applicant is a self-practicing doctor then he must be between 21 to 65 years of age

Pros and Cons of HDFC Doctor’s Superia Credit Card

Everything has two sides like that of a coin and similarly, the HDFC Doctor’s Superia Credit Card has its own advantages as well as disadvantages. We are going to discuss the same in the following table:

| Pros | Cons |

| – The Card has an affordable annual fee of Rs. 1,000 only. – Bonus Points are offered not just in the first year, but every year on card renewal. – Accelerated reward points are offered on dining spends. – No add-on fee is there for supplementary cards. |

– There is no free airport lounge access. – The reward Points conversion rate to Airmiles is too low, i.e, 667 Reward Points = 100 AirMiles. |

Conclusion

HDFC Bank Doctor’s Superia Credit Card is a comprehensive credit card solution for all doctors. It comes with notable features that any doctor would love to take advantage of and use to enhance their travel and dining experiences. Another card that is offered by the bank exclusively for Doctors is the Doctor’s Regalia Credit Card. Needless to say, the HDFC Bank Doctor’s Superia Credit Card is liked by most doctors owing to its customized benefits. Like any other credit card, it comes with certain liabilities and one should maintain punctuality related to balance payments to avoid any financial burden associated with it.