How to get Cred application loan

In today’s world, credit has become an essential tool for managing personal finances. Whether it’s for buying a house, car, or starting a business, credit is often necessary to achieve our financial goals. However, obtaining credit can be challenging, especially for those with limited credit history or poor credit scores. Fortunately, with the advent of technology, there are now several ways to obtain credit, including through online lending platforms such as Cred Application.

Cred Application is a mobile-based lending platform that provides instant loans to eligible customers. The platform uses advanced algorithms to evaluate borrowers’ creditworthiness and determine the loan amount and interest rate that they qualify for. In this article, we will discuss how to get a Cred Application loan, including the application process, eligibility criteria, and tips for improving your chances of approval.

What is Cred Application?

Cred Application is a mobile-based lending platform that provides instant loans to eligible customers. The platform was launched in 2018 and has since become one of the leading online lending platforms in India. The platform uses advanced algorithms to evaluate borrowers’ creditworthiness and determine the loan amount and interest rate that they qualify for.

Cred Application offers various loan products, including personal loans, business loans, education loans, and medical loans. The loan amounts range from INR 5,000 to INR 5,00,000, with repayment tenures ranging from 3 months to 36 months.

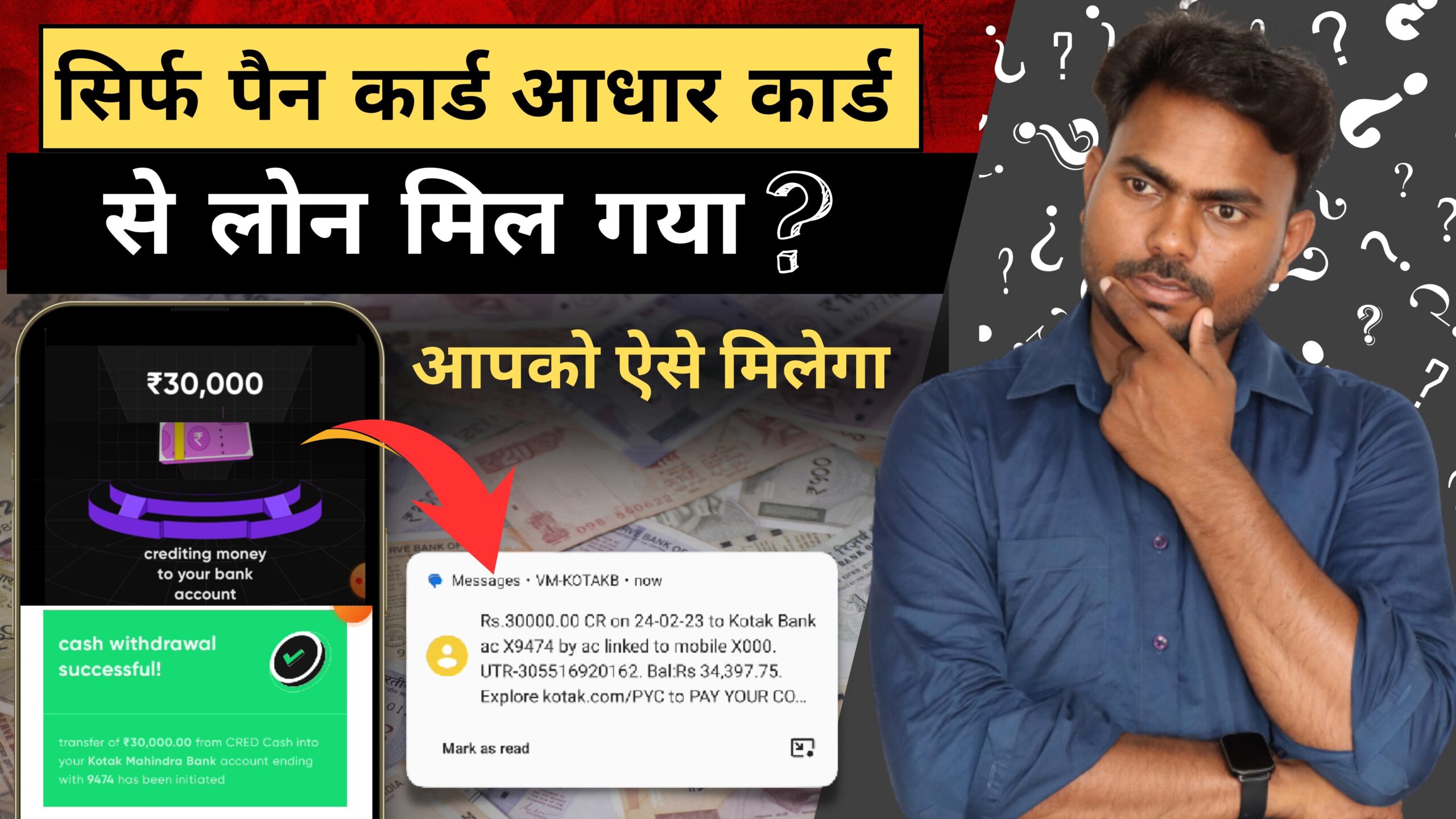

Cred Application’s lending process is entirely digital, with no paperwork or physical visits required. Customers can apply for loans through the mobile app, and the loan amount is disbursed directly to their bank account within minutes of approval.

How to get a Cred Application loan?

Getting a Cred Application loan is a straightforward process that involves the following steps:

Step 1: Download the Cred Application mobile app

The first step to getting a Cred Application loan is to download the mobile app from the Google Play Store or Apple App Store. The app is free to download, and you can create an account within minutes.

Step 2: Complete the registration process

Once you have downloaded the app, you will need to register by providing your mobile number and email address. You will then need to verify your mobile number by entering the OTP sent to your phone.

Step 3: Check your eligibility

Before applying for a loan, you should check your eligibility by entering your basic details, such as your income, age, and employment status. Cred Application will use this information to determine whether you meet the eligibility criteria for a loan.

Step 4: Apply for a loan

If you are eligible for a loan, you can apply by entering the loan amount and repayment tenure that you require. You will also need to provide additional information, such as your PAN card number, bank account details, and address proof.

Step 5: Wait for approval

Once you have submitted your loan application, you will need to wait for Cred Application to evaluate your application and determine whether to approve it or not. The evaluation process typically takes a few minutes, and you will receive a notification on the app once your loan has been approved.

Step 6: Receive funds

If your loan is approved, the funds will be disbursed directly to your bank account within minutes. You can then use the funds for any purpose, such as paying bills, starting a business, or investing in education.

Eligibility criteria for Cred Application loan

To be eligible for a Cred Application loan, you must meet the following criteria:

- Age: You must be at least 21 years old and not more than 65 years old.

- Income: You must have a minimum monthly income of INR 15,000.

- Credit score: You must have a