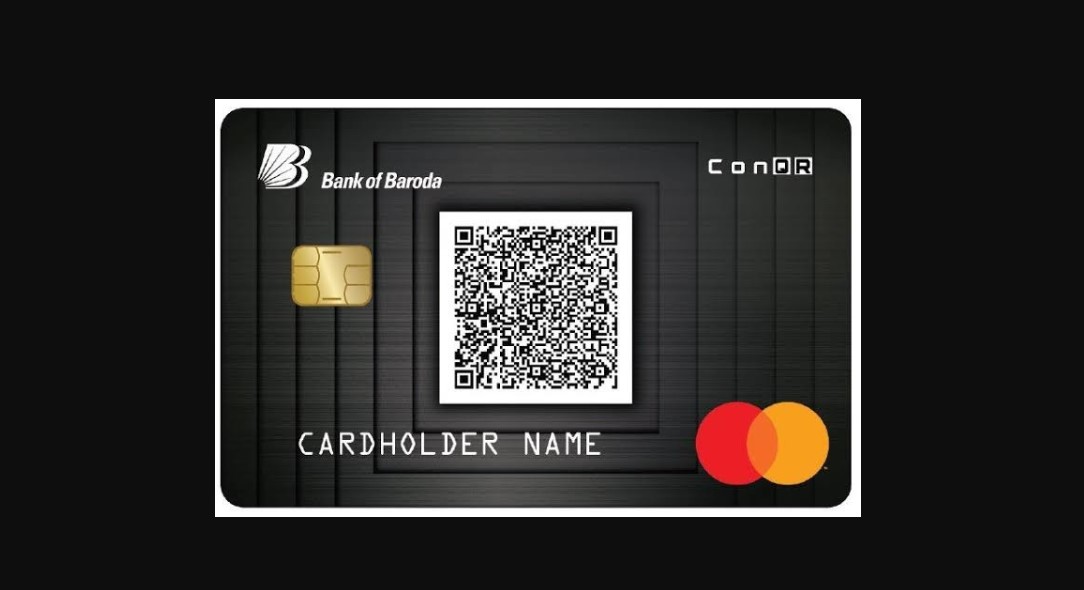

Bank of Baroda ConQR Credit Card

Along with offering several personal credit cards in different categories, BoB Financial also has business credit cards in its portfolio. One such card is the Bank of Baroda ConQR Credit Card which is solely aimed at providing business owners with maximum rewards and benefits with no additional charges. It is a lifetime free credit card and comes with a decent reward across different categories. You get up to 5 Reward Points on every spend of Rs. 100 and these rewards are redeemable against a variety of options available at the BoB Rewards portal. Moreover, the card offers exciting deals and discounts on flight & hotel bookings. Other benefits of this card include insurance covers against personal accidental death, 1% fuel surcharge waiver, zero liability protection against a lot/stolen card, and many more. To know more about the Bank of Baroda ConQR Credit Card and all its features, keep reading the article:

- Joining Fee- Nil

- Renewal Fee- Nil

- Best Suited For- Travel | Shopping

- Reward Type- Reward Points

- Welcome Benefits- NA

Rewards and Benefits

- Movie & Dining- NA

- Rewards Rate- Get 1 Reward Point on every retail spend of Rs. 100 and 5 Reward Points on every Rs. 100 spent on dining, utility bills, and online purchases.

- Reward Redemption- The reward points earned using this credit card can be redeemed against lots of options available at the BoB Rewards portal. 1 Reward Point = Re.0.25.

- Travel- Get up to Rs. 800 discount on flight bookings and great discounts on hotel bookings at Fab hotels, Vista rooms, and Treebo hotels.

- Golf- NA

- Domestic Lounge Access- NA

- International Lounge Access- NA

- Insurance Benefits- Get a personal air accident cover worth Rs. 15 lakhs and a non-air accident cover worth Rs. 5 lakhs.

- Zero Liability Protection- The cardholders will not be liable for any fraudulent/unauthorized transactions made on a lost/stolen card if the loss is reported to the bank in a timely manner.

Fees & Charges

- Spend based Waiver- NA

- Rewards Redemption Fee- Nil

- Foreign Currency Markup- 3.50% of the total conversion amount

- Interest Rates- 3.25% per month

- Fuel Surcharge- 1% fuel surcharge waiver on all fuel transactions between Rs. 400 and Rs. 5,000. The maximum waiver per month is capped at Rs. 250.

- Cash Advance Charge- 2.5% of the withdrawn amount or Rs. 300 (at domestic ATMs), and 3% of the withdrawn amount or Rs. 300 (at international ATMs)

- Add-on Card Fee- Nil

Product Details

- Get up to 5 Reward Points on every spend of Rs. 100.

- Save up to Rs. 800 on your flight bookings with EaseMyTrip.

- Save up to Rs. 750 on Fab hotel bookings with this credit card.

- Avail of up to 15% discount on Apollo Pharmacy products.

- Save up to Rs. 5,000 on booking two or more nights in Vista rooms.

- Get personal accident cover worth up to Rs. 15 lakhs.

- Get a 30% discount on all your Printvenue orders.

- Get a 1% fuel surcharge waiver.

Bank of Baroda ConQR Credit Card Features and Benefits

The BoB ConQR Credit Card is a lifetime free business credit card that comes with decent reward rates and a few more benefits across different categories. The rewards and benefits offered with this credit card are mentioned below:

Travel Benefits

- Get an Rs. 400 discount on one-way domestic flight bookings and Rs. 800 discount on return flight bookings via EaseMyTrip.

- Get up to Rs. 750 off on Fab hotels on bookings worth Rs. 1,999 or more.

- Get discounts up to Rs. 5,000 on booking two or more nights at Vista rooms.

- Save Rs. 1,000 on Treebo Hotel Bookings.

Insurance Benefits

- Get a personal air accident cover worth Rs. 15 lakhs.

- Get a non-air accident cover worth Rs. 5 lakhs.

Other Benefits

- Get a 15% discount on health and wellness products from Apollo Pharmacy.

- Get a 30% discount on all your spends on Printvenue.

Fuel surcharge Waiver

- Get a 1% fuel surcharge waiver on all fuel purchases between Rs. 400 and Rs. 5,000.

- The maximum waiver is capped at Rs. 250 per statement cycle.

BoB ConQR Credit Card Reward Points

- You get 1 Reward Point on every spend of Rs. 100.

- You get 5 Reward Points on every spend of Rs. 100 on dining, online spends, and utility bill payments.

Reward Redemption

- You can redeem your earned reward Points against a host of options from the boB rewards portal.

- The Reward Points are also redeemable against cashback at a rate of 1 Reward Point = Re. 0.25.

BoB ConQR Credit Card Eligibility Criteria

The following are the eligibility criteria required to get approved for the Bank of Baroda ConQR Credit Card:

- The primary cardholders should be above 18 years of age.

- The applicant should have a stable income source.

- The applicant’s proprietorships establishments should be where BoB POS machines have been installed.

- The applicant should be an Indian resident.

Documents Required

To get the Bank of Baroda ConQR Business Credit Card, you will have to submit the following documents:

- Photocopy of your PAN card.

- Passport-sized photograph.

- Photocopy of your current address proof (such as Aadhar Card, Voter ID, Passport, and latest utility bills).

- Business registration certificate with Sales tax number/TIN no. mentioned in it.

- Passport-size photograph.

How To Apply For BoB ConQR Credit Card?

To apply for the Bank of Baroda ConQR Credit Card online, follow the steps given below:

- Go to BoB financial’s official website.

- Choose the Bank of Baroda ConQR Credit Card.

- Click on the option ‘Apply Now.’ (Contact customer care if you don’t see the apply now option).

- You will be shifted to an application form, which you need to fill in carefully.

- After entering all the required details, complete all other formalities.

You can also apply offline for the ConQR card by visiting your nearest Bank of Baroda branch. Just make sure to carry all the above-mentioned documents and fill in the physical application form carefully.

Conclusion

The BoB ConQR Credit Card is a business card that comes with a zero annual fee, i.e. the cardholders can avail of all its benefits without paying an annual membership fee. As it is a business card, you need to be a business owner in order to get approved for it. Moreover, there are a few more eligibility requirements that you need to fulfill. From a decent reward rate to exciting discounts on travel-related bookings, the card provides you with great features that you can hardly expect from a lifetime free card. This was the BoB ConQR Credit Card review from our side. Make sure to let us know your views on this in the comment section below!