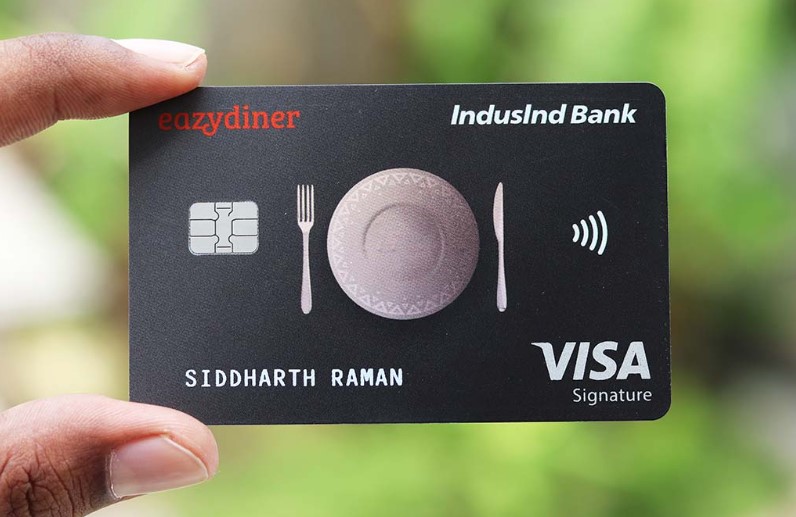

EazyDiner Indusind Bank Credit Card

IndusInd Bank has recently launched an exciting credit card in collaboration with EazyDiner, a popular online app for dining and table reservations. The name of this card is EazyDiner IndusInd Bank Credit Card It incurs a currency conversion fee of INR 1,999 and welcomes cardholders with a bonus of INR 2,000 and a complimentary EazyDiner Prime membership, which gets automatically renewed every year. Cardholders are rewarded with a competitive reward rate on every category of expenditure, and they also earn instant points for dining transactions through the EazyDiner app. Additionally, cardholders enjoy up to a 50% discount on dining expenses through EazyDiner, 3x EazyPoints on all orders, and several other benefits on dining.

Speaking of the travel benefits of this credit card, it provides access to domestic airport lounges in various cities across India, including select domestic lounges at major airports. Moreover, the card offers up to 2 free movie tickets every month on BookMyShow. All these benefits make the annual fee of this card highly worthwhile. For more detailed information about the fees, charges, and features of the EazyDiner IndusInd Bank Credit Card, please refer to the details provided below:

- Joining Fee-Rs. 1,999 plus applicable taxes

- Renewal Fee-Rs. 1,999

- Best Suited For-Dining

- Reward Type-Reward Points

- Welcome Benefits-2,000 bonus RPs and complimentary membership of EazyDiner Prime.

Rewards and Benefits

- Movie & Dining- Up to 50% additional discounts on dining spends via the EazyDiner app

- Rewards Rate- 4 Reward Points per Rs. 100 retail spend and 10 Reward Points for dining spends through the EazyDiner app.

- Reward Redemption- The reward points earned are redeemable for payment of bills via the EazyDiner app.

- Travel- Complimentary access to domestic lounges every year

- Golf- NA

- Domestic Lounge Access- 2 complimentary access to domestic lounges every quarter.

- International Lounge Access- NA

- Insurance Benefits- NA

- Zero Liability Protection- If any unauthorized transaction is performed on the lost or stolen card, the liability will not fall on the cardholder provided that the bank has been reported in a timely manner.

Fees & Charges

- Spend based Waiver- NA

- Rewards Redemption Fee- Nil

- Foreign Currency Markup- 3.5% of the total transaction amount

- Interest Rates- 3.83% per month

- Fuel Surcharge- 1% fuel surcharge waiver on transactions between Rs. 400 and Rs. 4,000 at fuel stations.

- Cash Advance Charge- 2.5% of the withdrawn amount subject to a minimum of Rs. 300.

- Add-on Card Fee- Nil

Product Details

- Welcome bonus of 2,000 bonus RPs once the card’s joining fee is paid.

- Complimentary EazyDiner Prime annual membership that gets renewed every year.

- Up to 50% extra discount on dining spends via the PayEazy on the EazyDiner app.

- Complimentary access to domestic lounges every year.

- Two complimentary movie tickets every month.

- 1% waiver on fuel surcharge.

EazyDiner IndusInd Bank Credit Card Features and Benefits

The EazyDiner IndusInd Bank Credit Card is a recently launched co-branded card that comes with exciting rewards rates and several other benefits across different categories. The following are the detailed benefits & features of this credit card:

Welcome Benefits:

- Get 2,000 Eazy Points after the joining fee has been successfully paid.

- Get Complimentary Eazy Diner Prime membership for a year. The membership can be renewed annually after the annual fee has been paid.

Dining Benefits

Being a credit card targeted at people who dine out very often, the EazyDiner IndusInd Bank Credit Card come with a number of exclusive dining privileges as follows:

- 25% discount on paying your dining bills via Payeazy on the EazyDiner app.

- Additional 25% off on paying bills using the EazyDiner IndusInd Bank Credit Card via PayEazy on the EazyDiner app.

- Get complimentary premium alcoholic beverages at selected restaurants across the country.

Movie Benefits

The EazyDiner IndusInd bank card also offers two complimentary tickets for movies that are worth up to Rs. 200 every month on BookMyShow.

Travel Benefits:

The cardholders get 2 complimentary access to domestic lounges per quarter (8 annually).

Fuel Surcharge Waiver

Get a 1 % waiver on the surcharge applicable on fuel purchases between Rs. 400 and Rs. 4,000.

EazyDiner IndusInd Bank Credit Card Reward Points

The reward rate of the EazyDiner IndusInd Bank Credit Card in different categories are as mentioned below:

- You get 10 Reward Points per Rs. 100 spent on dining, entertainment, and shopping.

- You get 4 Reward Points on every other retail spend of Rs. 100.

Other than the Reward points, you can also earn 3x (12 Reward Points per Rs. 100 you spend) EazyPoints on making payments via the EazyDiner IndusInd Card.

Reward Redemption

The Reward Points accumulated via the EazyDiner IndusInd Bank Credit Card are redeemable against dining-related spends on the EazyDiner app. These reward points can not be redeemed against cash credit and they expire after one year from the accumulation date.

EazyDiner IndusInd Bank Credit Card Fees and Charges

Following are the important charges applicable on the EazyDiner IndusInd Bank Card:

- The joining & renewal fee applicable on the card is Rs. 1,999 plus applicable taxes.

- The finance charges applicable on IndusInd Bank EazyDiner Credit Card are 3.83% p.m.

- The foreign currency markup fee applicable on the card is 3.5% of the transaction amount.

- The cash advance fee applicable on EazyDiner IndusInd Bank Card is 2.5% of the amount withdrawn (minimum of Rs. 300).

EazyDiner IndusInd Bank Credit Card Eligibility Criteria

The eligibility criteria to get approved for the EazyDiner IndusInd Bank Credit Card have been mentioned below:

| Particular | Criteria |

| Age | Above 21 years |

| Income | Stable income as a salaried or self-employed |

| Credit Score | Decent credit score (750 or above) |

Documents Required

The documents that are required to apply for the EazyDiner IndusInd Bank Credit Card have been mentioned below:

- Identity Proof: PAN Card, Aadhar Card, Voter’s Id, Driving License, or Passport.

- Address Proof: Aadhar Card, Passport, utility bills, or Driving License.

- Income Proof: Latest salary slips or bank statements (in case of salaried individuals), and audited ITR (in case of self-employed).

How To Apply For The EazyDiner IndusInd Bank Credit Card?

The IndusInd Bank EazyDiner Credit Card can be applied by online and offline methods. If you prefer offline methods, then simply visit the bank branch in your city and fill in the application form. If you prefer online ways, then the following steps would guide you to apply for the card:

- Visit Bank’s official website.

- Under ‘Products’ tab, click on Credit Card.

- Select the EazyDiner IndusInd Bank Credit Card.

- Proceed further to apply as per the website’s directions.

Conclusion

The EazyDiner IndusInd Bank Credit Card is indeed a great option for individuals who frequently enjoy dining out. While the renewal fee may appear high, considering all the benefits that come with this card, paying the fee is entirely justified. Along with the complimentary EazyDiner Prime membership worth INR 1,995, this credit card allows you to earn instant rewards on dining expenses and provides up to a 50% discount and various other advantages. Additional benefits such as lounge access and free movie tickets on BookMyShow make it a luxurious credit card that offers excellent privileges in different categories. While HDFC Regalia Credit Card is also a lifestyle card that offers exciting dining offers, the EazyDiner IndusInd Bank co-branded card remains the best choice for food enthusiasts.