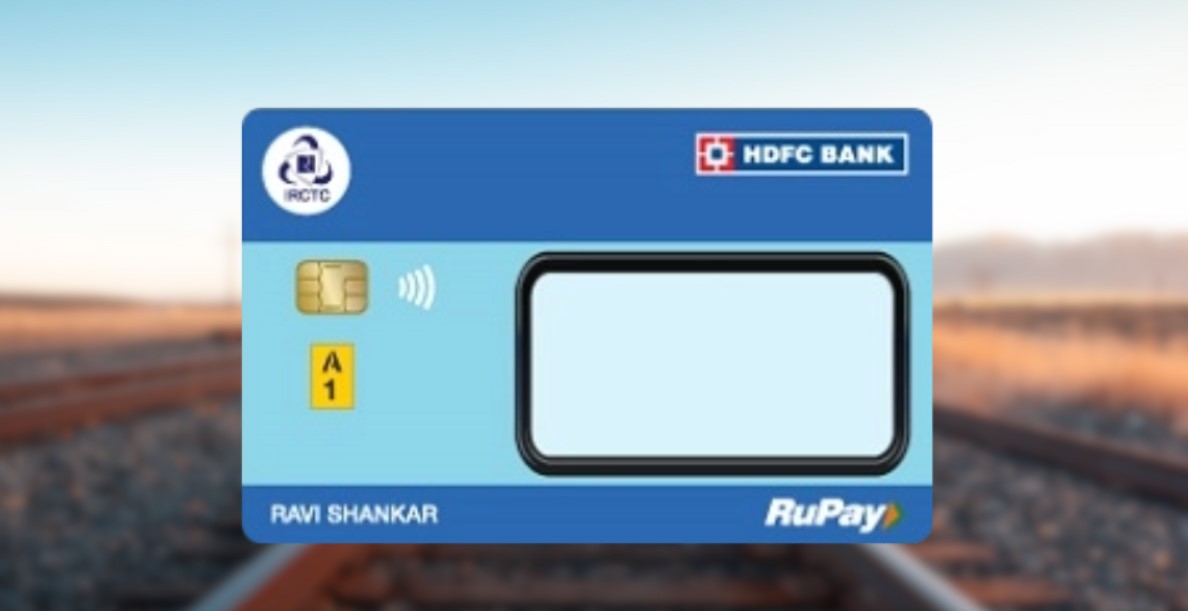

HDFC Bank RuPay IRCTC Credit Card, Rewards and Benefits, Joining Fees & Charges, Apply Online

HDFC Bank and IRCTC have partnered together to launch a co-branded credit card the HDFC IRCTC Credit Card. The card is on the Rupay platform. As the name suggests this credit card targets people who travel constantly on trains. So, what are the features of the HDFC IRCTC credit card and does it earn a place in your portmanteau? Read on to find out.

| Fees | Joining Fee- Rs. 500+ GST Renewal Fee- Rs. 500+ GST |

| Best Suited For | Travel |

| Reward Type | Reward Points |

| Welcome Benefits | Amazon voucher worth Rs. 500 on making the first sale within the first 30 days. Rewards and Benefits |

Rewards and Benefits

- Movie & Dining- NA

- Prices Rate- 1 Cash Point for every retail spend ofRs. 100 and 5x Cash Points on IRCTC bookings.

- Price Redemption- The earned Cash Points can be redeemed against trip bookings via IRCTC and several other options. 1 Cash Point = up to Re. 1.

- Trip- Get 8 complimentary access to IRCTC Executive couches.

- Golf- NA

- Domestic Lounge Access- NA

- International Lounge Access- NA

- Insurance Benefits- NA

- Zero Liability Protection- The cardholders get a zero liability protection against a misplaced/ stolen card if reported to the bank in a timely manner.

Fees & Charges

- Spend Grounded Waiver-The renewal figure is waived on spendingRs.1.5 lakhs or further in the former time.

- prices Redemption figure- nill

- Foreign Currency Luxury- of the sale quantum

- Interest Rates- per month.

- Energy Cargo- 1 energy cargo disclaimer on all energy deals.

- Cash Advance Charges- of the cash quantum orRs. 500( whichever is advanced)

- Add- on Card figure- nill

Product Details

- Amazon voucher worthRs. 500 as a welcome benefit.

- 1 Cash Point for everyRs. 100 spent on retail purchases.

- 5x Cash Points on IRCTC spends.

- Complimentary road chesterfield access every time.

- Spend- grounded disclaimer of the renewal figure.

- 1 energy cargo disclaimer.

Pros/Cons

Pros

- largely salutary card for frequent peregrination with complimentary access to Administrative couches of IRTC(

- 8 in a timetable time).

- 5 price points on each ₹ 100 spent on the IRCTC website and app and an fresh 5 cashback on train ticket

- purchases through HDFC SmartBuy.

Cons

- There’s a minimal 100- point limit for redemption of prices.

- The price points can only be used to buy train tickets on the HDFC SmartBuy platform.

Prices and Benefits

Welcome Benefit Gift testimonial worth 500 on card activation within the first 30 days. No minimal spending criterion is mentioned.

The HDFC Bank IRCTC RuPay Credit Card is a travel-oriented credit card that offers a competitive reward rate and a range of benefits across various categories, including travel and more. Here are some of the features and benefits of this card:

Welcome Benefits: Upon activation of the card and making the first transaction within 30 days of issuance, you receive an Amazon voucher worth Rs. 500.

Travel Benefits: Cardholders are entitled to 2 complimentary railway lounge access (IRCTC Executive Lounge) every quarter, totaling 8 accesses per year.

Transaction Charges Waiver: Enjoy a waiver of transaction charges for railway bookings between Rs. 400 and Rs. 5,000.

Fuel Surcharge Waiver: Get a 1% fuel surcharge waiver on fuel purchases between Rs. 400 and Rs. 5,000, with a maximum waiver of Rs. 250 per billing cycle.

Renewal Fee Waiver: The renewal fee of Rs. 500 is waived off if you spend Rs. 1,50,000 or more in the previous anniversary year.

Milestone Benefits: Receive gift vouchers worth ₹500 on spends of ₹30,000 or more every 90 days.

UPI Enabled: The card is UPI enabled for easy access and transactions.

Reward Points: Earn 1 Cash Point for every retail spend of Rs. 100 and 5x Cash Points on IRCTC bookings. Additionally, get an extra 5% discount on IRCTC bookings via HDFC SmartBuy.

Reward Redemption: Cash Points can be redeemed against railway bookings through the IRCTC app/website at a rate of 1 Cash Point = Re. 1. For flight/hotel bookings through IRCTC and other options, 1 Cash Point = Re. 0.30.

Fees and Charges: The card has a joining and annual membership fee of Rs. 500 plus applicable taxes, with the renewal fee waived on spending Rs. 1.5 lakhs or more in the previous anniversary year. The cash advance fee is 2.5% of the withdrawn amount, subject to a minimum of Rs. 500. The interest rate is 3.6% per month, and the foreign currency markup fee is 3.5% of the total transacted amount.

Eligibility Criteria: Applicants should be between 21 and 65 years old, either self-employed or salaried with a stable monthly income.

In conclusion, the HDFC Bank IRCTC RuPay Credit Card offers a host of benefits for frequent railway travelers in India, making it an attractive option for those looking for a rewarding credit card experience.