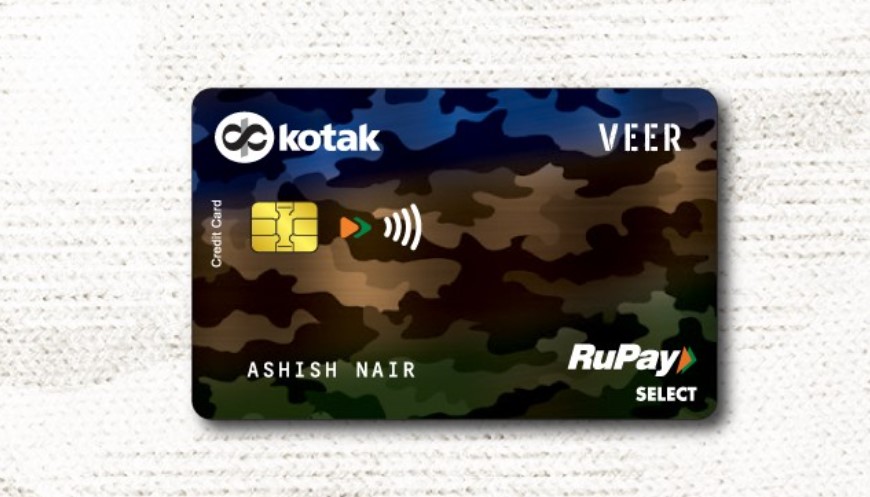

Kotak Veer Select Credit Card

Issued by Kotak Mahindra Bank, the Veer Select Credit Card is an exclusive card for the officials of the Indian armed forces. It is a special card to honour the brave guardians of our nation. This credit card enables them to manage their essential purchases while earning rewards and avail of several other exciting benefits. It comes with a zero joining fee and renewal fee of Rs. 599 that can be waived off on the basis of the total annual spends of the cardholders. As a welcome benefit, cardholders get access to complimentary IHO membership worth Rs. 8,500 on spending Rs. 500 in the first 30 days.

Along with this, the cardholders get multiple other benefits such as a 1% fuel surcharge waiver, 1.8% railway surcharge waiver, and complimentary access to domestic airport lounges every year. With a really good reward rate, this card enables the armed force official to earn benefits on their daily expenditures so that their experience of shopping, dining and purchasing essentials is enhanced. Read below to know more about this card.

- Joining Fee- NA

- Renewal Fee- Rs. 599

- Best Suited For- Shopping

- Reward Type- Reward Points

- Welcome Benefits- Complimentary IHO membership worth Rs. 8,500 on spending Rs. 500 within the first 30 days of card issuance.

Rewards and Benefits

- Movie & Dining- NA

- Rewards Rate- 3 Reward Points on every spend of Rs. 200, and 3x Reward Points on movies, dining, and departmental stores.

- Reward Redemption- Redeem points against a host of categories such as Movies, Mobile Recharges, and e-vouchers. 1 Kotak Reward Point = Re. 0.25.

- Travel- Complimentary access to domestic airport lounges

- Golf- NA

- Domestic Lounge Access- 2 complimentary domestic airport lounge access every quarter

- International Lounge Access- NA

- Insurance Benefits- Insurance cover worth Rs. 2.5 lakhs against unauthorized transactions on a lost/stolen card

- Zero Liability Protection- Zero liability protection against a lost/stolen card is provided to the cardholder if the loss is reported to the bank immediately.

Fees & Charges

- Spend based Waiver- On spending Rs. 1,00,000 on retail purchases, the annual fee for the next year is waived.

- Rewards Redemption Fee- NA

- Foreign Currency Markup- 3.5%

- Interest Rates- 3.5% per month (42% annually)

- Fuel Surcharge- 1% fuel surcharge waiver across all petrol pumps (capped at Rs. 3500 annually)

- Cash Advance Charge- Rs. 300 per withdrawal of Rs. 10,000.

- Add-on Card Fee- Nil

Product Details

- Get complimentary IHO membership worth Rs. 8,500 as a welcome benefit on spending Rs. 500 in the first 30 days

- Earn 9 reward points on every Rs. 200 spent on movies, dining, grocery, and departmental stores

- Get 3 reward points on every Rs. 200 spent in all other categories

- 8 complimentary domestic airport lounge access per year (capped at 2 per quarter)

- Enjoy an annual fee waiver on the spending of Rs. 1,00,000

- 1% fuel surcharge waiver across all fuel stations (capped at Rs. 3500 per annum)

- 1.8% railway surcharge waiver on the IRCTC website; 2.5% for transactions on Indian Railway Booking Counters

Kotak Veer Select Credit Card Features and Benefits

As mentioned earlier, the Kotak Veer Select Credit Card is exclusively for the Indian Defense Service officials and comes with a lot of exciting advantages across different categories. Following are the detailed features and benefits of this credit card:

Welcome Benefit

As a welcome benefit, you get complimentary IHO membership worth Rs. 8,500 on spending Rs. 500 within the first 30 days of card issuance.

Reward Benefits

- Get 9 reward points on every Rs. 200 spent on movies, dining, grocery, or departmental stores.

- Get 3 reward points on every Rs. 200 spent on other categories.

Reward Redemption

- The accumulated Veer Points can be redeemed against a host of categories such as Movies, Mobile Recharges, and e-vouchers, where the value of 1 Reward Point = Re. 0.25.

- These points can be redeemed directly at kotakrewards.com or partner stores and websites for shopping, travel, recharge, and more.

- If reward points are not sufficient for a particular transaction, you can pay the rest of the amount with your Kotak credit card.

Travel Benefits

You get to enjoy complimentary access to domestic airport lounges 8 times a year (maximum 2 times a quarter).

Insurance Benefits

- If your credit card is lost or stolen, you get a credit liability worth up to Rs. 2.5 Lakh against any fraudulent transaction made through your card.

- To avail of the insurance, immediately contact the Customer Contact Centre 1860 266 2666 to get your card deactivated/blocked

- Next, register a claim with the Insurance company.

Fuel Surcharge Waiver

You can avail of a 1% fuel surcharge waiver on transactions between Rs 500 and Rs 3,000. You can get a maximum fuel surcharge waiver of Rs 3,500 annually. No reward points get credited on fuel transactions.

Railway Surcharge Waiver

You can avail of a 1.8% railway surcharge waiver on transactions done through www.irctc.co.in and a 2.5% waiver on transactions done at Indian Railway Booking Counters.

Spend-Based Waiver

The renewal fee of Rs. 599 is waived off on spending Rs. 1 lakh or more in the previous year.

Kotak Veer Select Credit Card Fees and Charges

There are some fees and charges associated with the Veer Select Credit Card, of which, some most important ones are given below:

- The joining fee of this card is zero and the annual fee of the Kotak Veer Select Card is Rs. 599.

- The card charges an interest of 3.5% per month.

- The cash advance fee of the Kotak Veer Select Credit Card is Rs. 300 for each withdrawal of Rs. 10,000.

- The forex markup fee on this credit card is 3.5%.

Kotak Veer Select Credit Card Eligibility Criteria

- The applicant should be an Indian armed force official.

- The applicant should be a resident of India.

- The age of the primary cardholder should be between 18-65 years.

- The age of the add-on cardholder should be 18 years or above.

- You can avail of this credit card at the following locations: Ahmedabad, Bangalore, Chandigarh, Chennai, Delhi (including Gurgaon and Noida), Hyderabad, Kolkata, Mumbai, and Pune.

Documents Required

You will also need a few documents to apply for the Kotak Bank Veer Select Credit Card, which are listed below:

- Identity Proof: Aadhar Card, Driving License, PAN Card, Passport, Voter’s Id, etc.

- Address Proof: Aadhar Card, Latest months’ water/electricity/telephone bills, Ration Card, rent agreement, etc.

- Proof of Income: Latest months’ salary slips/bank statements or latest ITR report.

How To Apply For Kotak Veer Select Credit Card?

The Kotak Mahindra Bank provides you with the convenience to apply for a credit card online as well as offline as per your comfort. You can apply for the card offline by visiting your nearest Kotak bank branch and filling out the offline form there. Make sure to carry all the essential documents along with you. You can also apply for the card online as follows:

- Visit the Kotak Mahindra Bank’s official website

- Click on the ‘Explore Products’ option.

- Go to the section ‘Cards’

- Then select ‘Credit Cards.’

- Choose the ‘Kotak Veer Select Credit Card,’ and click on Apply Now option.

- Fill in all the required information and proceed further.

Conclusion

The Kotak Veer Select Credit Card is a special card for the armed forces official. Kotak made this card to give something back to those who selflessly guard our nation every day. SBI Card also offers two such cards, out of which, the SBI Shaurya Select Credit Card is very much comparable to this one. The Veer Select card is beneficial for them as it enables them to earn reward points on all their spends and accelerated rewards on selected categories like movies, dining, groceries, etc. Other than this, the travel requirements of the cardholders have also been kept in mind by the card issuer as the card comes with complimentary airport lounge access. Moreover, this card also provides a 1% fuel surcharge waiver across all petrol stations, so you can pay for fuel using it without any worries. Another key feature of this card is that you get an annual fee waiver on the expenditure of Rs.1,00,000 in the previous year. Undoubtedly, this credit card is a one-stop purchasing solution for the brave soldiers of our country.