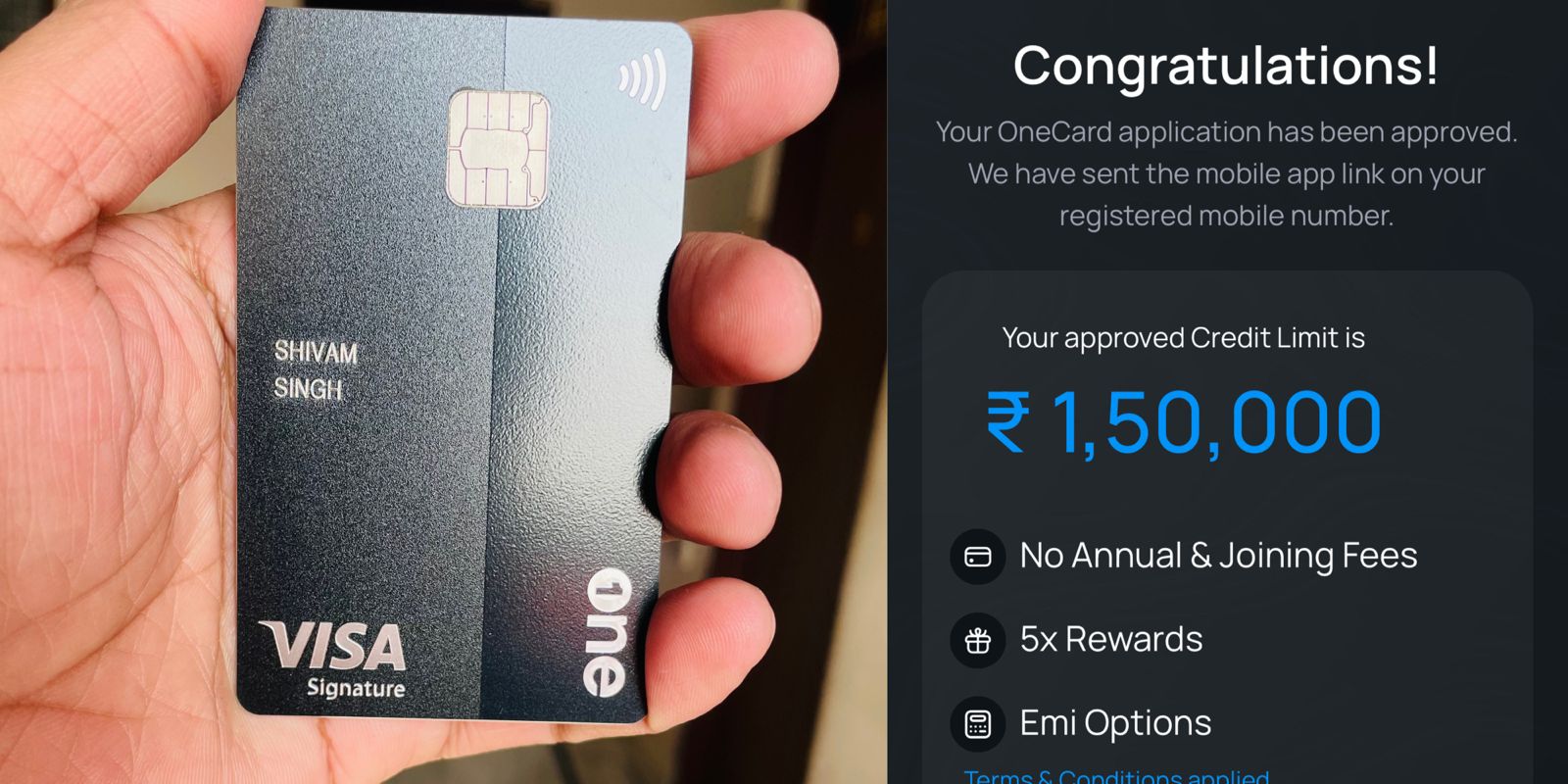

One Card Credit Card – This credit card is for those who are taking credit card for the first time and whenever you shop or buy something with this card, you get reward points. There is a special thing in this card that in this you do not have to pay joining or annual fees. And for One Card Credit card you do not even need CIBIL SCORE, so you can avail its benefits without any fees.

One Card Credit Card Kya He

OneCard is a special metal credit card that is provided in collaboration with many banks in India, such as SBM Bank, South Indian Bank, Federal Bank, BOB Financial and CSB Bank. In this you get free membership for the whole life!

One Card Features And Benefits

1. No joining or annual fees – There is no joining fees or annual fees in this credit card card, you can become a card holder.

2. Earn 1 reward point for every ₹50 spent – You will earn 1 reward point for every ₹50 spent. Meaning whenever you spend money, you will get points!

3. Choose 2 categories to earn 5X reward points – You can choose 2 categories where you will get 5X reward points. This will give you extra points!

4. Reward points never expire – Your reward points will never expire, you can use them whenever you want!

5. Redeem points for cash back, gift cards, or travel benefits – You can use your points for cashback, gift cards, or travel benefits! There are options for you when you use your points.

6. 0 CIBIL SCORE Approval – For One Card Credit card, you do not even need CIBIL SCORE, even if you do not have even 1 credit card, you will still get One Card Credit card.

One Card Eligibility Criteria

- 1. Must be a resident of India!

- 2.Must be at least 18 years old!

- 3.Must have a valid PAN card!

- 4.There should be stable income!

- 5.CIBIL score should be 750 or above.

- 6.It should be possible to provide valid identity and address proof!

One Card Document Required

1. Click on Apply Now button!

2. Enter your personal information, such as your name, email address, and contact details.

3. About your financial information, such as your income and employment status.

4. Upload required documents!

5. Submit your application!

One Card Fees and Charges

Joining Fee – Nil

Annual Fee – Nil

| Card Re-issuance Charges | Plastic Card

2nd Replacement 3rd Replacement Onward Metal Card |

Nil

RS. 145 Rs. 500 Rs. 3000 |

| Card Cancellation Fee | Card Cancellation Within 6 Months of Virtual Card being activatedPlastic Card Metal card |

Rs. 500

Rs. 3000 |

Intrest Rate And Late Payment Fee

| Finance Charges | 2.5% to 3.5% p.m. (30% to 42% p.a.) |

| Late Payment Fee | 2.5% of total amount due (Max. Rs. 1,000) |

Conclusion (One Card Credit Card)

So friends, this is how you can apply for One Card, I sincerely hope that you liked this article.

I hope that you have got complete information about One Card from this post, if you still feel that some improvements need to be made in this post, then you can tell us by commenting.

Also, if you liked this post, then share it with all your social media accounts and friends. So that they can also know about this.