Thinking of traveling around the world and even planning a proper wedding ceremony? Take a personal loan to fulfill your wishes.

A private mortgage has flexible repayment terms and often does not require any security or collateral.

Here’s a five-step guide on how you can get a private mortgage. From the paperwork required to how you can apply for a private mortgage, we’ve got all the aspects covered:

Step 1: Decide Your Requirement

Determine why you want a private mortgage and how much you want. For example, it is possible that you need a mortgage to fund your wedding ceremony or to renovate your home. And it is possible that you will only need Rs. 1 lakh or Rs. 10 lakhs.

Step 2: Test Mortgage Eligibility

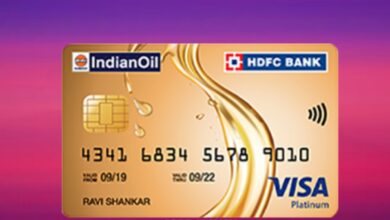

Once you know how much you want, it is best to check whether you are eligible or not. To know how much you can borrow as a personal mortgage, you can visit the HDFC Bank Personal Loan Eligibility Calculator online. HDFC Bank offers loans up to Rs. 40 lakhs.

Read more about how you can calculate your private mortgage EMI and how you can reduce it.

Step 3: Calculate Monthly Installments

Use the Internet EMI tool to calculate your estimated mortgage repayment every month. You will be able to modify the interest rate and tenure to match your month-to-month income, just like in the HDFC Bank Personal Loan EMI Calculator. HDFC Bank offers pocket friendly EMIs on all its personal mortgages starting from Rs. 1878 per lakh* (T&C).

Step 4: Method the financial institution

You can apply for a private mortgage with HDFC Bank in a number of ways: via netbanking, online at the HDFC Bank website, at an ATM or by visiting a branch.

Step 5: Submit Paperwork

Find out later what documents are required for a private mortgage. Generally, you will have revenue proof (financial institution statements, wage slips or IT returns), tackle proof and ID proof. Hand over copies of your private mortgage paperwork to the financial institution.

Wait for the funds to be sent to your account. Funds are disbursed in 10 seconds* for pre-approved loans to HDFC Financial Institution customers and 4 hours* for non-HDFC Financial Institution customers.

This is how you can get a private mortgage in 5 simple steps! Now, live gracefully and make your wishes come true!

Want to apply for a private mortgage? Click here to get started.

* Phrases and conditions apply. Private Mortgage Disbursement at the discretion of HDFC Financial Institution Ltd.