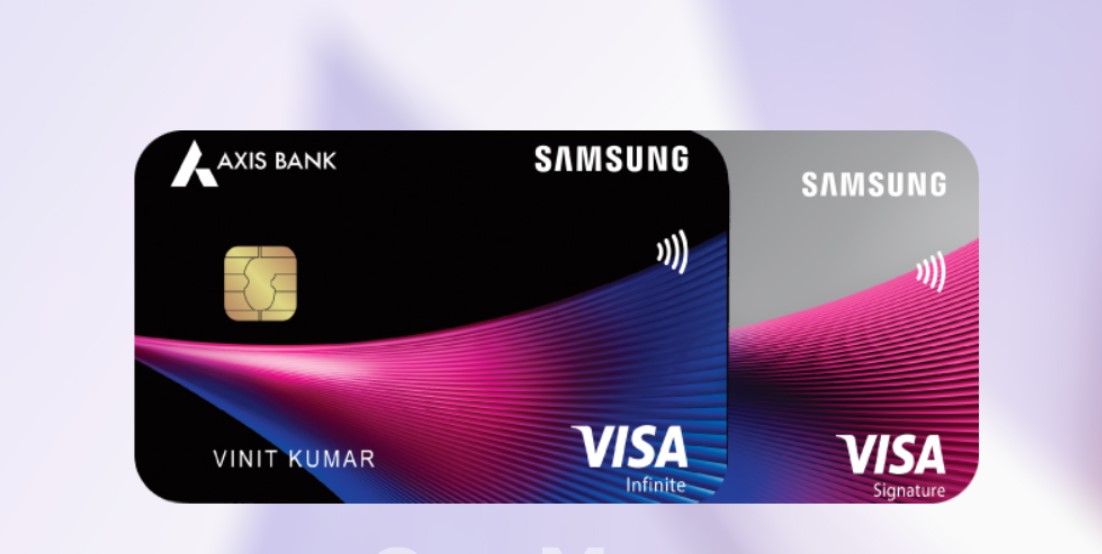

Samsung Axis Bank Signature Credit Card

Axis Bank recently joined hands with the famous electronics brand, Samsung, to launch two co-branded credit cards. These cards are Samsung Axis Bank Infinite Credit Card and Samsung Axis Bank Signature Credit Card. Out of the 2 cards, the Infinite card is a premium card and the Signature variant is the basic one. Though the Samsung Axis Bank Signature Card is a basic card, it offers a great cashback rate on Samsung purchases. the card comes with an annual fee of Rs. 500, which is waived off on achieving the required annual spend. Other than Samsung purchases, the card offers a great reward rate on other spends as well.

Moreover, the card offers complimentary lounge access to selected domestic airports in India and exciting dining discounts across several premium restaurants. Other benefits of this card include bonus Reward Points as a welcome benefit, fuel surcharge waiver, zero liability protection against a lost/stolen card, etc. To know more about the Samsung Axis Bank Signature Credit Card and its fees & charges, continue reading:

- Joining Fee- Rs. 500

- Renewal Fee- Rs. 500

- Best Suited For- Shopping

- Reward Type- Reward Points

- Welcome Benefits- 2,500 bonus Edge Rewards on making at least 3 transactions within the first 30 days of card issuance.

Rewards and Benefits

- Movie & Dining- 15% discount on dining across over 4,000 premium restaurants twice every month.

- Rewards Rate- 10 Edge Rewards on every Rs. 100 spent on partnered brands and 5 Edge Rewards on other spends.

- Reward Redemption- The earned Edge Rewards can be redeemed against various options available on Axis Bank’s Edge Rewards portal at a rate of 1 Edge Reward = Re. 0.20.

- Travel- Complimentary airport lounge access every year.

- Golf- NA

- Domestic Lounge Access- 4 complimentary domestic lounge access every year.

- International Lounge Access- NA

- Insurance Benefits- NA

- Zero Liability Protection- Get a zero liability protection against a lost/stolen card on reporting the loss to the bank in a timely manner.

Fees & Charges

- Spend based Waiver- The annual fee of Rs. 500 is waived on spending Rs. 2 lakhs or more in the previous anniversary year.

- Rewards Redemption Fee- Nil

- Foreign Currency Markup- 3.5% of the total transaction amount

- Interest Rates- 3.6% per month

- Fuel Surcharge- 1% fuel surcharge waiver on all fuel purchases between Rs. 400 and Rs. 4,000.

- Cash Advance Charge- 2.5% of the withdrawn amount subject to a minimum of Rs. 500.

- Add-on Card Fee- Nil

Product Details

- Welcome benefits of 2,500 bonus Edge Rewards.

- 10% cashback on all Samsung purchases.

- 10 Edge Rewards on every Rs. 100 spent on partnered brands.

- 5 Edge Rewards on every Rs. 100 spent elsewhere.

- Complimentary domestic lounge access every year.

- 15% discount on dining spend across several premium restaurants.

- 1% fuel surcharge waiver on all fuel transactions.

Samsung Axis Bank Signature Credit Card Features and Benefits

From welcome bonus to reward points to travel privileges, the Samsung Axis Bank Signature Credit Card comes with a lot of privileges across different categories. All its benefits and features are given below in detail:

Welcome Benefits

The cardholders get a welcome bonus of 2,500 Edge Reward Points. One needs to make a minimum of three transactions within the first 30 days to become eligible for this welcome benefit.

Lounge Access

The Samsung Axis Bank Signature Card offers 4 complimentary domestic airport lounge access every year, i.e. 1 every quarter.

Dining Benefits

- The cardholders can avail of a 15% discount (up to Rs. 500) on dining across more than 4,000 premium restaurants in India.

- This dining discount can be availed twice every month.

Fuel Surcharge Waiver

The card offers a 1% fuel surcharge waiver on all fuel transactions between Rs. 400 and Rs. 4,000.

Spend-Based Waiver

The renewal fee of Rs. 500 is waived off if the cardholder has spent a minimum of Rs. 2 lakhs in the previous anniversary year.

Samsung Axis Bank Signature Credit Card Rewards & Cashback

- The Samsung Axis Bank Signature Cardholders get a 10% cashback on all their purchases from the Samsung brand. The cashback under this category is capped at Rs. 2,500 per month and Rs. 10,000 per anniversary year. Moreover, the cashback will only be applicable to purchases made via Samsung offline stores, brand EMI, Samsung app/website, or Flipkart.

- The cardholders earn 10 Edge Rewards on every spend of Rs. 100 on partnered brands, including BigBasket, Myntra, Zomato, UrbanCompany, Tata1mg, etc.

- On all other domestic & international transactions, the cardholders earn 5 Edge Rewards on every spend of Rs. 100.

- No Edge Rewards are earned on fuel purchases, cash advances, payment of credit card fees, rental payments, and EMI transactions on brands other than Samsung.

Reward Redemption

- The edge Reward Points that you earn using this card can be redeemed against various products, vouchers, and other options available at the axis Bank’s edge Rewards portal. The value of 1 Edge Reward = Re. 0.20

- The cashback is directly credited to the cardholders’ accounts within 60 days from the date of the eligible transaction.

Eligibility Criteria

Following are the eligibility criteria that an individual needs to fulfill to get approved for the Samsung Signature Credit card by Axis Bank:

- The primary cardholder’s age should be between 18 years and 70 years.

- The supplementary cardholder must be above 18 years of age.

- The applicant should be having a stable source of income.

- The applicant should be an Indian resident.

Documents Required

Following are the necessary documents that are required to apply for the card:

- Identity Proof – Passport, Aadhar Card, PAN Card, Driving Licence, and a photograph (passport size).

- Address Proof – Utility bills (latest months’ electricity/telephone bills), Aadhar Card, Passport, etc.

- Income Proof – Latest payslip/latest bank statements, Form 16, latest audited ITR, etc.

Conclusion

The Samsung Axis Bank Signature Credit Card is a great choice for those who are loyal to the Samsung brand for all their electronic-related purchases. Moreover, it can also be considered a great choice for people who look for an affordable credit card with decent privileges across different categories. This card doesn’t only offer a great cashback rate on Samsung purchases, but it also provides cardholders with several other benefits, including a decent reward rate on other spends, complimentary lounge access, dining discounts every month, and many more. Though the Samsung Axis Bank Infinite Credit Card offers more privileges, it also charges a higher annual fee compared to the Signature variant. So, the Samsung Axis Bank Signature Card is a very good option for those who look for decent benefits with lower annual charges.