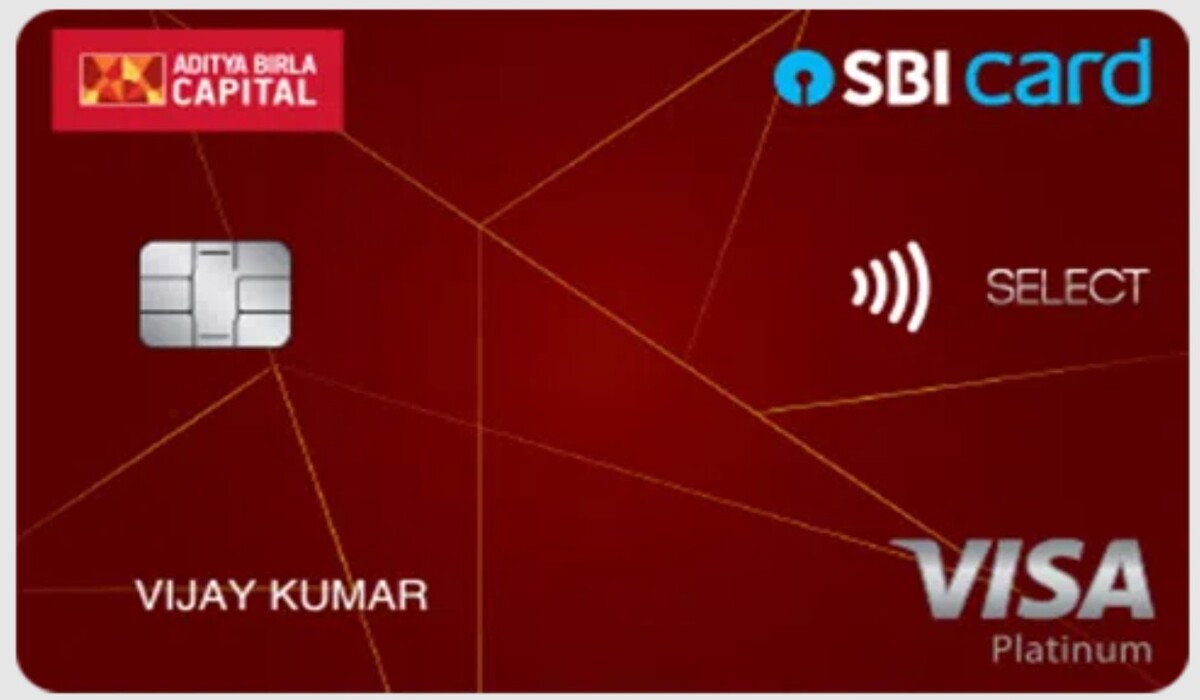

Aditya Birla SBI Card SELECT, Rewards and Benefits, Joining Fees & amp; Charges, Apply Online

Aditya Birla SBI Card SELECT: The collaboration between HDFC and Paytm has resulted in a highly anticipated co-branded offering aimed at redefining digital payments and banking services for consumers. This strategic partnership combines HDFC Bank’s renowned banking expertise with Paytm’s innovative digital payment platform, promising users a seamless and rewarding financial experience.

At the core of this co-branded offering lies an extensive suite of digital payment solutions seamlessly integrated with HDFC Bank’s banking services. Users can leverage Paytm’s robust digital ecosystem to facilitate a wide range of transactions, including bill payments, recharges, online shopping, peer-to-peer transfers, and more, all accessible through HDFC Bank’s user-friendly interface. This integration not only simplifies the payment process but also empowers users with greater flexibility and control over their finances, irrespective of their location.

One of the key highlights of the HDFC and Paytm co-branded offering is its enticing rewards and benefits program. Designed to cater to diverse spending habits and preferences, this program offers users various incentives such as cashback, discounts, vouchers, and reward points on eligible transactions, including shopping, dining, travel, and utility payments. Moreover, new users are welcomed with exclusive introductory offers, enhancing the value proposition of the co-branded offering and fostering long-term engagement.

Security is paramount in the HDFC and Paytm co-branded offering, with robust measures in place to safeguard users’ financial information and transactions. Advanced encryption, two-factor authentication, and real-time transaction monitoring ensure that users can transact with confidence, knowing that their sensitive data is protected against potential threats.

With a focus on accessibility and customer support, the HDFC and Paytm co-branded offering aim to deliver a superior digital payment experience, driving financial inclusion and empowerment for users across India. Whether it’s everyday transactions or more significant financial endeavors, this collaboration promises to redefine the way users interact with their money in the digital age.

| Fees | Joining Fee- Rs. 1,499 + GST Renewal Fee- Rs. 1,499 + GST |

| Best Suited For |

Travel | Shopping |

| Reward Type | Reward Points |

| Welcome Benefits |

6000 Rewards Points on card issuance.

|

Rewards and Benefits

- Rewards Rate:- Earn 20X Reward Points for every Rs. 100 spent at Aditya Birla Stores, 10X Reward Points for every Rs. 100 spent on Entertainment, Dining, and Hotels, and 2X Reward Points for every Rs. 200 spent on other categories.

- Reward Redemption:- Redeem your Reward Points for gift vouchers on sbicard.com or the SBI mobile app, or use them against your card’s outstanding balance. Each Reward Point is valued at Rs. 0.25.

- Travel:- Enjoy complimentary access to lounges across India, adding comfort and convenience to your travels.

- Domestic Lounge Access:- Receive 4 complimentary accesses to Domestic Airport Lounges, enhancing your pre-flight experience.

- Insurance Benefits:- Stay protected with comprehensive insurance coverage tailored to your needs.

- Zero Liability Protection:- Rest easy knowing you’re covered against unauthorized transactions with Zero Liability Protection.

Fees & Charges

Experience the convenience and flexibility of the Aditya Birla SBI Card with the following features:

- Spend Based Waiver:- Enjoy benefits tailored to your spending habits.

- Rewards Redemption Fee:- Avail rewards redemption for just Rs 99 per request, making it easier to access your benefits.

- Foreign Currency Markup:- A 3.5% markup applies to foreign currency conversions, ensuring seamless transactions abroad.

- Interest Rates:- Benefit from competitive interest rates of 3.5% per month (42% per annum), offering financial flexibility.

- Fuel Surcharge:- Receive a 1% surcharge waiver on fuel transactions at all fuel stations across India, saving you money on every fill-up.

- Cash Advance Charges:- Access cash easily with a cash advance charge of 2.5% on the transaction amount, with a minimum charge of Rs 500.

- Add-on Card Fee:- Enjoy the convenience of an add-on card at no additional cost, extending the benefits of your Aditya Birla SBI Card to your loved ones.

Product Details

- Get an astounding 20X Reward Points for every Rs. 100 spent at Aditya Birla Stores.

- Indulge in leisure and dining experiences with 10X Reward Points for every Rs. 100 spent on Entertainment, Dining, and Hotels.

- Earn 2X Reward Points for every Rs. 200 spent on all other categories.

Enjoy savings every time you fuel up with a 1% fuel surcharge waiver.

Relax and unwind before your flight with 4 complimentary Domestic Airport Lounge accesses.

Unlock additional rewards as you spend:

- Earn 3000 Rewards Points upon spending Rs. 1.5 lakh.

- Receive an extra 3000 Rewards Points upon reaching a spending milestone of Rs. 3 lakh.

Experience the power of rewards with the Aditya Birla SBI Card.

Aditya Birla SBI Card SELECT Features and Benefits

Introducing the Aditya Birla SBI Card SELECT: Your Gateway to Rewards and Privileges

Experience a world of rewards and privileges with the Aditya Birla SBI Card SELECT, a premium offering from SBI Card that promises unmatched benefits and exclusive privileges. From welcome rewards to milestone benefits, this card is designed to elevate your lifestyle and provide you with unparalleled experiences.

Welcome Benefits: Kickstart your journey with 6000 Rewards Points upon paying the joining fee, ensuring that you start reaping the rewards from day one.

Milestone Benefits: Reach new milestones and be rewarded generously. Earn 3,000 RPs when you spend Rs. 1.5 Lakh or more in each anniversary year, with an additional 3,000 reward points when you reach the Rs. 3 Lakh spending mark in a year.

Travel Benefits: Travel in style with up to 4 complimentary domestic lounge access every year, allowing you to relax and unwind before your flights, making your travel experience truly luxurious.

Fuel Surcharge Waiver: Enjoy savings on fuel expenses with a 1% fuel surcharge waiver on transactions between Rs. 500 and Rs. 3,000, capped at Rs. 100 per month, ensuring that your journeys are not only convenient but also cost-effective.

Rewards Program: Maximize your rewards with every spend. Earn 20X Reward Points for every Rs 100 spent at Aditya Birla Stores, 10X Reward Points for every Rs. 100 spent on Entertainment, Dining, and Hotels, and 2X Reward Points per Rs. 200 spent on other categories, ensuring that every purchase rewards you generously.

Rewards Redemption: Redeem your Reward Points for a wide range of options, including gift vouchers or product catalogs on sbicard.com or the SBI mobile app, or even use them to pay off your card’s outstanding balance via internet banking, ensuring flexibility and convenience in redemption. With 1 RP equal to Rs. 0.25, your rewards are within easy reach.

Experience the ultimate in rewards and privileges with the Aditya Birla SBI Card SELECT. Elevate your lifestyle and enjoy unmatched benefits that cater to your every need. Apply for your card today and unlock a world of possibilities.

| Fee | Charged |

| Joining/Annual fee | Rs. 1499 |

| Interest Charges | 3.5% p.m. (42% p.a.) |

| Foreign Markup Fee | 2.5% of the transaction amount |

| Cash Advance Fee | 2.5% (minimum Rs. 250) |

Essential Documentation for SELECT Card Application:

When applying for the SELECT Card, ensure you have the following documents ready:

1. Identity Proof – Provide any of the following: PAN Card, Voter’s ID, Passport, Aadhar card, or Driving License.

2. Address Proof – Submit any of these: Utility Bills, Ration Card, Aadhar Card, or Passport.

3. Income Proof – Furnish either 3 months’ salary slips, 3 months’ bank statement, or audited financial report.

How to Apply for the Aditya Birla SBI Card SELECT:

Applying for the SELECT Card is convenient through both offline and online channels:

Offline Application:

Visit your nearest SBI Branch and complete the application form provided.

Online Application:

1. Navigate to the official SBI Card website.

2. Go to the credit cards section.

3. Choose the Aditya Birla SBI Card SELECT and select “apply now.”

4. Complete the online application form and submit it for processing.

Checking Aditya Birla SBI Card SELECT Application Status:

If you’ve applied for the SELECT Card and wish to track your application status, follow these steps:

1. Visit the official SBI website.

2. Navigate to the “Credit Cards” section.

3. Scroll down to find the “Track Application” link.

4. Enter your application number and click “Track” to receive updates on your application status.

In Summary

The Aditya Birla SBI Card SELECT stands out with its generous reward points, particularly for purchases made at Aditya Birla stores. It’s particularly beneficial for frequent shoppers at Aditya Birla Brands, offering substantial rewards on purchases. Additionally, the card provides attractive benefits such as domestic lounge access, along with enticing welcome and milestone rewards. For those interested in exploring other SBI card options with offers on Aditya Birla Fashion, options like the SBI Prime Credit Card and SBI TATA Platinum Card are worth considering. Share your thoughts and opinions on the card in the comments section below.

Apply Now |

Click Heare |