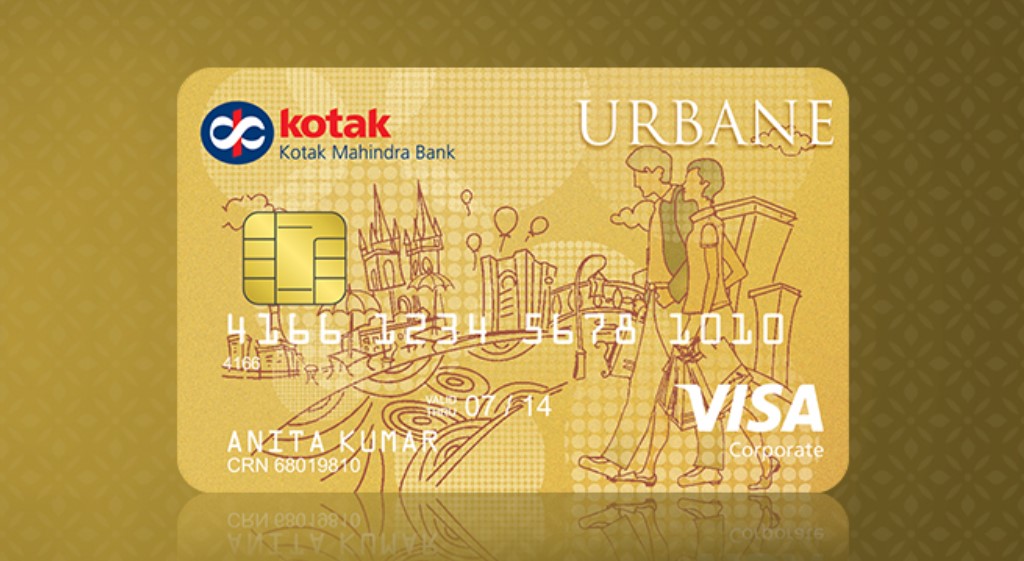

Kotak Urbane Gold Credit Card

Issued by Kotak Mahindra Bank, Kotak Urbane Gold Credit Card is well designed to suit the needs of frequent shoppers as it offers rewards for all the purchases made. The card carries a very nominal fee of Rs. 199 and provides amazing benefits in comparison to the fee it charges. This card lets you earn 3x reward points per Rs. 100 spent on all retail spends. Additionally with this card you can get upto 4 PVR tickets or 10,000 rewards points upon spending Rs. 1 Lakh or more in a year. These movie tickets can be claimed any time, anywhere. And the reward points are redeemable against Airtickets, Movie Tickets, Mobile Recharge etc. Along with these privileges, this card provides a credit shield of Rs. 50,000 if the card is lost. To know more about the Urbane Gold card By Kotak Bank, keep reading the article below:

- Joining Fee- Nil

- Renewal Fee- Rs. 199 (plus applicable taxes)

- Best Suited For- Shopping

- Reward Type- Reward Points

- Welcome Benefits- NA

Rewards and Benefits

- Movie & Dining- NA

- Rewards Rate- 3x Reward Points per Rs. 100 you spend on all retail transactions

- Reward Redemption- Redeem the earned points for various categories like Movie Tickets, Mobile Recharge, etc. Rewards Points can used to pay your shopping bills through PayByPoints Program

- Travel- NA

- Golf- NA

- Domestic Lounge Access- NA

- International Lounge Access- NA

- Insurance Benefits- Insurance cover for a lost or stolen card

- Zero Liability Protection- Zero Liability Protection for a lost or stolen credit card upon reporting to the bank’s customer care.

Fees & Charges

- Spend based Waiver- Get the annual fee waived on spending Rs. 15,000 in the previous year.

- Rewards Redemption Fee- Nil

- Foreign Currency Markup- 3.5% on all foreign transactions

- Interest Rates- 3.5% per month (or 42% annually)

- Fuel Surcharge- NA

- Cash Advance Charge- Rs. 300 per Rs. 10,000 withdrawn

- Add-on Card Fee- Nil

Product Details

- 3x Reward Points per Rs. 100 spent

- Either 4 PVR Tickets or 10,000 Reward Points as Milestone benefit

- Insurance coverage for a lost card

- Get add-on card and enjoy added benefits

Kotak Urbane Gold Credit Card – Features and Benefits

The Kotak Urbane Gold Credit Card is exclusively designed for those who love shopping. This card provides amazing rewards on all the retails spends. Also, it provides you with the feature of an add-on card and this card will have all the features that the primary card holds. The reward points earned with the card are redeemable for various categories like e-vouchers for various brands, product purchases, etc. The detailed features of the Kotak Urbane Gold Credit Card are as follows:

Reward Benefits

- On using Kotak Urbane Gold Credit Card, you receive 3x Reward Points per Rs. 100 spent on all retail spendings.

Reward Redemption

The reward points are redeemable in multiple ways –

- Redeem for Movie Tickets through BookMyShow or PVR, Mobile Recharges, shopping vouchers, Air Tickets, etc.

- Use points to shop at selected merchant stores via PayByPoints Program.

- Redeem for cash wherein 1000 Reward Points = Rs. 100. Also, you need to have at least 1000 Reward Points accumulated to initiate redemption in cash.

Milestone Benefits

With Kotak Urbane Gold Credit Card, upon reaching the spending limit of Rs. 1,00,000 ; you have the option to avail any 1 of the following milestone benefits :

- Free PVR Tickets – 4

- Bonus Reward Points – 10,000

If you opt for PVR Tickets, you can use them for any day, any show and can even transfer them. These can be redeemed against movie tickets booked through www.pvrcinemas.com. These can be claimed within 3 months of the expiry of the program period. Further, the tickets have to be priced under Rs. 400. If you book a ticket that costs you more than Rs. 400, you will have to pay the amount over and above Rs. 400.

If you opt for Rewards Points, they will be credited in your account in the next billing cycle and can be redeemed against AirTickets, Movie Tickets, Mobile Recharge or Branded Merchandise. The reward points can be claimed within three months of the expiry of the program period.

Spend based Waiver

Annual fee of Rs. 199 can be waived if you spend Rs. 15,000 in the last year.

Credit Shield

A Credit shield worth Rs. 50,000 is provided for stolen card against all unauthorized transactions up to 7 days prior to reporting.

Other Benefits

The additional card (add-on card) facility can be availed for your family members which is issued against the primary card. The add-on cards have the same features and benefits that the primary card holds.

Kotak Urbane Gold Credit Card: Fees and Charges

- Annual Fee/Joining fee: The joining fee is zero and annual fee is Rs. 199 for the Kotak Urbane Gold Credit card.

- Interest charge: The card carries 3.5% p.m. (42% p.a.) as the finance charges.

- Forex Mark-up Fee: A foreign currency mark-up fee of 3.5% (plus applicable taxes) of the transaction amount is applicable.

- Cash Advance Charges: A charge of Rs. 300 is applicable per R. 10,000 withdrawn.

Eligibility Criteria for Kotak Urbane Gold Credit Card

Following are the Eligibility criteria applicable for the Urbane Gold card by Kotak Bank which need to be fulfilled by the applicant:

| Particular | Criteria |

| Age | Between 21 Years and 65 Years |

| Income | Above Rs. 3 Lakhs |

| Credit Score | Decent credit score (750 or above) |

This card is applicable only in a few locations as of now which are- Ahmedabad, Chennai, Bangalore, Delhi (including Gurgaon and Noida), Kolkata, Mumbai, Hyderabad, Navi Mumbai & Pune

How to Apply for Kotak Urbane Gold Credit Card

The Kotak Urbane Gold card can be applied by any of the following 2 methods:

For online mode –

- Visit Kotak Mahindra Bank

- Click on ‘Explore Products’

- Go to ‘Cards’ and select ‘Credit Cards’

- Select ‘Kotak Urbane Gold Credit Card’ and click on apply now

- Fill in all the details and submit the documents.

For offline mode –

To apply offline, simply visit the nearest bank branch and fill in the application form and attach the documents asked.

Conclusion

The Kotak Urbane Gold Credit Card is a special card that offers several benefits on shopping, dining, and grocery purchases. With no joining fee and a nominal annual fee of Rs. 199, getting 3x reward points for spends of Rs. 100 is a great deal. It has got various discount offers, movie vouchers, and a good product catalog to choose from to redeem the reward points. Another card that is very much comparable to this card is the PVR Kotak Gold Credit Card which is exclusively for movie lovers. Also, PayByPoints is a significant feature of the Urbane Gold Card wherein you can shop at select merchants using the reward points earned. It is a good option for the new entrants in the world of credit cards, who would love to shop and earn amazing rewards.